The rise of e-commerce…and the problem it creates

2014 was a record year for ecommerce revenue. Sources estimate that US holiday season shoppers spent over $50 billion online, while sales in the UK exceeded £100 billion for the full year and totaled almost $450 billion in China for 2014. There’s no doubt that a percentage of this growth comes at the expense of offline stores and brands with multiple channels are struggling to decide how to support all outlets.

Enter O2O: “online-to-offline commerce.”

Since the rise of e-commerce in the 1990s, retailers have experimented with ways to connect dot-com to legacy offline stores. In those days, brands would occasionally offer web-only coupons that could be printed out and redeemed in-store. Twenty years after Amazon.com first went live, the most effective tactic for driving online eyeballs to offline stores is still the coupon, albeit evolved via Groupon and LivingSocial. Other contemporary O2O tactics are also derivative from the days before e-commerce existed, like publishing weekly sales circulars online as PDFs or highlighting a brand’s latest TV commercials on its website. It’s time for these tactics to evolve.

Retailers have been the earliest to embrace O2O, but digital disruption has impacted companies of all kinds, from advertising to venture capital. Uber and Lyft have changed the way people (and regulators) think about hiring cars. AirBnB and HomeAway have changed behaviors around renting a room for the night. Nest and SmartThings have changed how people interact with their homes. Warby Parker has changed how people shop for eyewear. Kickstarter and Indiegogo have changed how business ventures obtain funding. The list goes on and on.

Risk adverse companies will take small, incremental, and defensive steps to integrate digital methods into their business models. These firms, many of them industry incumbents, will slowly fade away. Brands that survive and thrive will embrace three key principles of O2O:

1. O2O applies to three primary venues: retail, home, and office

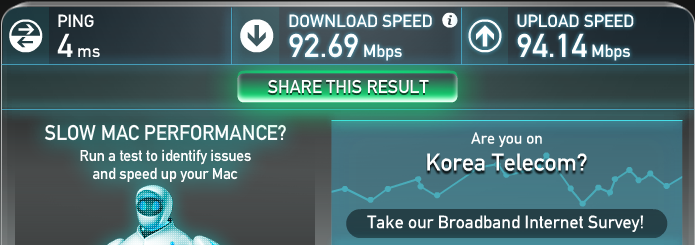

Korea is one of the most wired countries on the planet and ground zero for O2O innovation.

In June 2014, Starbucks launched its Siren Order app in Korea, bridging the gap between office and retail by enabling customers to order and pay in advance. After a successful rollout, the app was rebranded “Mobile Order & Pay” for launch in the U.S. in December.

Also in December, Burberry opened a “Burberry Beauty Box” store in Seoul, including an RFID-enabled “Digital Lip & Nail Bar” to help customers match products to their skin tone.

Beyond retail and office, the “Internet of Things” has captured mainstream awareness and companies including SmartThings/Samsung, Nest/Google, and Quirky/GE are enabling digitally connected home environments.

2. O2O works best in both directions

O2O is most commonly an abbreviation for “online-to-offline” and the reverse should also be true. Circuit City, Borders, and Blockbuster have all disappeared after being unable to implement effective offline-to-online strategies. Today’s operating environment contains increasingly powerful personal computing devices, widespread broadband connectivity, and changes in consumer attitudes towards sharing and engagement.

Nordstrom takes advantage of these trends by investing in technology to enable sales associates to deliver more effective customer service, integrating in-store merchandising with social media content, and offering free wifi to improve in-store customer experience. Success – and perhaps survival – depends on merging channel service levels to deliver customer experiences that meet and exceed expectations.

3. O2O is a business strategy

Making O2O work effectively requires commitment and coordination across internal departments approaching programs as part of strategy, not as seasonal campaigns. A single department might champion O2O initiatives, but success requires collaboration from IT, supply chain, marketing, and customer service. The unifying focus for these efforts should be how to deliver the best user experience optimized for customer segments, supported by process improvements and technology infrastructure. Solid use cases are required prior to implementing O2O strategy.

For example, Samsung created a B2B product called CenterStage, displaying appliances in life-size 4K UHD at retailers including Best Buy, Dixons, and Boulanger, reducing inventory carrying cost and floor space typically required by traditional white goods displays.

Strategies can benefit brands in industries far beyond retail

Over the course of 2015, the lines between online and offline will continue to blur. As revenue from online retail continues to grow, brands must be careful to not get distracted by the larger opportunity. Brands that build their business models around an O2O approach will create consumer value in the three key venues of shop, home and office. These brands will be the best prepared to increase market share while defending existing business from new digitally disruptive entrants.