South by Southwest (SXSW) Interactive 2015 is over and by all accounts it was bigger than ever before. This was my seventh consecutive year attending and speaking and I’ve witnessed this evolution firsthand. More so than in any prior year, my week in Austin left me with the impression that SXSW matters more than ever for brands and is currently the top “must attend” event for marketers.

Previously, many brand-side executives dismissed the notion of traveling to Austin in March, despite the allure of beer, barbecue and warm Texas weather. SXSW used to be called “spring break for geeks” – considered more of a social scene for techies than a place for brands to get business done.

This year’s festival leaned towards the regional and the niche. But with the rise of digital and convergence of culture and technology in society, the content and communities of SXSW Interactive have become increasingly relevant to a wide range of audiences.

This year, I saw three key reasons why brands should save the date for 2016:

1. Major digital trends are on display

I’ve been tracking a series of key global digital trends since the beginning of the year and have seen them reinforced at CES, Mobile World Congress and now, SXSW.

First is the evolution of natural interfaces. There were plenty on display, from startups showcasing gesture-based and augmented reality offerings, to panel discussions regarding the evolution of fabrics and wearables.

Another global trend is the rise of smart machines and practical application of data. General Electric, for example, held a “barbecue lab” at this year’s event to explore the science of what makes barbecue great, based on science.

Finally, the internet of things was put into action as 1,000 Bluetooth beacons were deployed throughout the city to connect attendees with each other and to provide information on the venues they were visiting.

2. Brands are building startup street cred

SXSW has always had client-side representation in attendance. However, in years past, marketers would attend individually or as part of a small team on a fact-finding mission. Now, big brands are paying big dollars to have a presence at the festival.

What really matters though is how traditional companies are reaching out and bridging the gap with startups. IBM, Visa and McDonalds all hosted startup pitch competitions during the festival. These brands are getting credit by association with new thinking, while getting a jump on disruptive innovation.

3. SXSW has become a global gathering

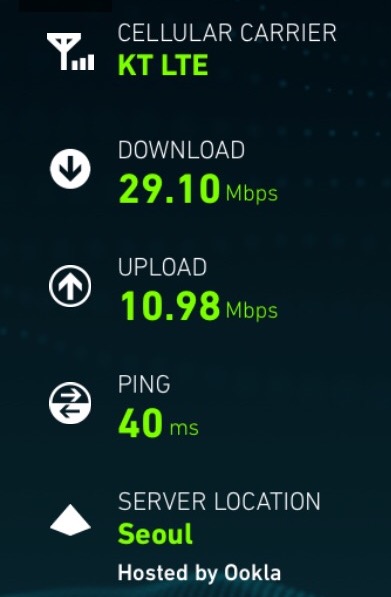

The attendee badge lists a person’s name, company and country. More often than not I saw non-US locations listed, including Germany, France, Korea, Japan, Sweden, the UK and beyond. SXSW has attracted a global audience that brands can connect with.

In stereotypical Texas style, everything at SXSW has become big. The amount of content offered, the number of attendees in town and the range of parties and concerts available were mind-boggling. It seems likely that next year’s conference will be even bigger and brands will bring out their best to shine brighter than their competitors in the warm Austin sun.

This post was originally published in The Guardian.

I took over as CEO of Barbarian Group in December 2015, tasked with turning an agency around that was in worse shape than anyone (i.e. executives, employees, clients, media, auditors, holding company) realized.

I took over as CEO of Barbarian Group in December 2015, tasked with turning an agency around that was in worse shape than anyone (i.e. executives, employees, clients, media, auditors, holding company) realized. If you weren’t around for the early days of this blog, you didn’t miss much. Maybe

If you weren’t around for the early days of this blog, you didn’t miss much. Maybe